If you’re serious about accelerating your trading journey in 2025, learning how to compare prop firms effectively is one of the biggest unlocks. Not all firms are built the same: some specialize in futures, others in forex; some offer rapid evaluations while others prioritize consistency and long‑term growth. This guide breaks down the core features that actually matter—so you can choose a firm that matches your strategy, risk tolerance, and goals.

WHY “COMPARE PROP FIRMS” MATTERS

When traders say “compare prop firms,” they’re usually trying to answer a few practical questions:

- How quickly can I qualify?

- Which rules could get me disqualified?

- What does payout look like—profit split, frequency, caps?

- What’s the true cost (fees, resets, platform/data)?

- Will this firm support the way I actually trade?

You can scan an always‑updated hub with live comparison tables, reviews, and tools here:

- Main hub: https://solvethatnow.com/compare-prop-firms

- Reviews: https://solvethatnow.com/compare-prop-firms#reviews

- Guides: https://solvethatnow.com/compare-prop-firms#guides

- Calculators: https://solvethatnow.com/calculators

THE CORE FACTORS THAT MATTER MOST

1) Evaluation Model & Time Constraints

- One‑phase vs two‑phase challenges: fewer phases can mean faster qualification, but rules may tighten elsewhere.

- Minimum trading days: if you’re a low‑frequency swing trader, confirm activity requirements.

- Time limits: some firms allow no time limit; others are strict.

2) Risk Rules & Drawdown

- Daily loss and max drawdown disqualify more traders than anything else.

- Static vs trailing drawdown; end‑of‑day (EOD) vs intraday matters a lot for futures.

- Consistency rules: if you size unevenly or take sparse A‑setups, check expectations before you begin.

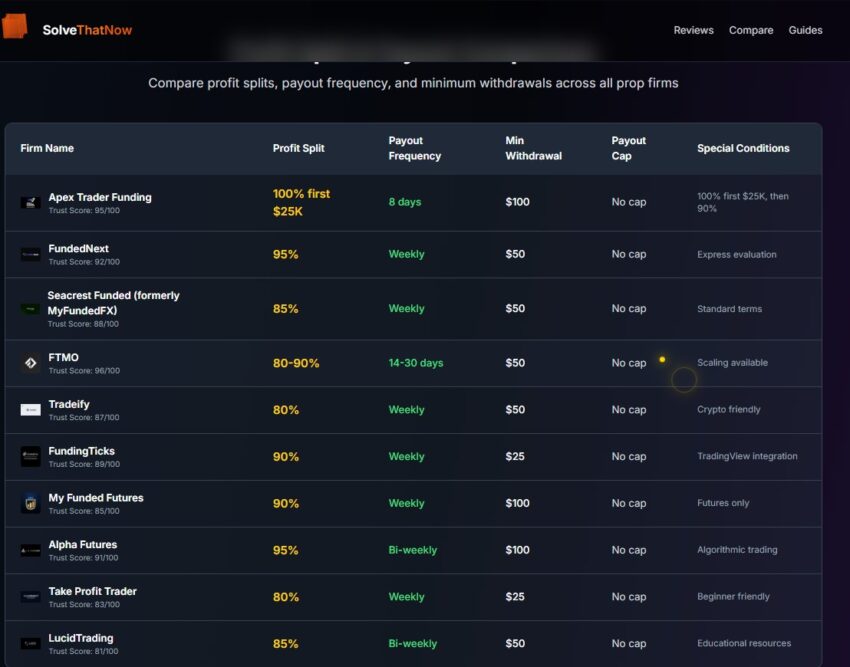

3) Payout Structure & Split

- Profit splits commonly range from 80–95%.

- Payout cadence can be weekly, bi‑weekly, or 14–30 days.

- Verify minimum withdrawals and any payout caps.

4) Platforms, Markets & Tools

- Forex, futures, crypto, indices—confirm your instruments and data.

- TradingView, MT4/5, NinjaTrader, or API access for systematic traders.

- Platform/data fees and any hidden costs.

5) True Cost (Not Just the Headline Fee)

- Challenge + activation + platform/data fees.

- Reset or retake costs if you barely miss a rule.

- Promo pricing helps, but don’t anchor your decision on it.

REAL‑WORLD SNAPSHOTS (2025)

Every trader is different, but here’s how three widely used firms align with different profiles:

- FTMO — reputation, stability, and a mature program. Balanced evaluation, strong support, and scaling opportunities. Deep dive: https://solvethatnow.com/prop-firms/ftmo

- Seacrest Funded (formerly MyFundedFX) — flexible rules for traders who need breathing room. FAQs, rules, and details: https://solvethatnow.com/prop-firms/myfundedfx

- Alpha Futures — strong for technically inclined/systematic traders who value API access and analytics. Overview: https://solvethatnow.com/prop-firms/alpha-futures

MATCH THE FIRM TO YOUR STRATEGY

- Scalpers: Look for clarity on intraday trailing drawdown, permission around news trading, and faster payout cadence.

- Swing traders: Favor EOD drawdown, overnight/weekend holds, and fewer “consistency” constraints.

- Systematic/quant: Platform stability, reliable data, and API access become non‑negotiable.

AVOIDING DISQUALIFICATION TRAPS

A few rules silently end challenges:

- Hidden news restrictions: confirm whether news trading is allowed or not.

- Overnight/weekend holds: if you swing trade, ensure these are acceptable.

- Daily loss vs max drawdown: know both numbers cold—set platform‑level risk controls.

RUN THE NUMBERS WITH TOOLS

Before funding, model scenarios with calculators:

- Profit projection, position sizing, drawdown tolerance, and payout cadence implications.

- Tools: https://solvethatnow.com/calculators

Read aggregated feedback from verified traders to validate your shortlist:

- Reviews: https://solvethatnow.com/compare-prop-firms#reviews

ACTION PLAN (QUICK START)

1) Define your priority: speed, rule flexibility, or payout terms.

2) Short‑list 3 firms that fit your trading style.

3) Compare head‑to‑head with the updated table: https://solvethatnow.com/compare-prop-firms

4) Run calculators to validate sizing and expected returns: https://solvethatnow.com/calculators

5) Deep dives:

- FTMO: https://solvethatnow.com/prop-firms/ftmo

- Seacrest Funded (formerly MyFundedFX): https://solvethatnow.com/prop-firms/myfundedfx

- Alpha Futures: https://solvethatnow.com/prop-firms/alpha-futures

The “best” prop firm is the one that fits your rules, platform needs, and payout preferences—without forcing you to change what you already do well. Use the live comparison, detailed reviews, and calculators to decide with clarity:

https://solvethatnow.com/compare-prop-firms